Finals are around the corner and you may have already started to feel the immense pressure as you burn the midnight oil, trying to cram all facts and formulas you’ve learnt over the past few months in less than a couple of weeks (or days) time. Have you felt like quitting at any point in time and having a sudden urge to spend all you can to enjoy? Or if you are a quiet person, chances are that you might vent by doing things alone such as stress eating. This is when budgeting comes in handy so you don’t burn a hole in your pocket and resort to fast food and instant noodles for the rest of the month. Budgeting is crucial for this is where you can control your spending or at least observe the changes in your spending patterns during these periods. In most cases, spendings during these periods will leap by multiple folds than the usual average, especially for those who relieve stress through eating, shopping or traveling. On the other extreme, there will be a drastic fall from the average spending for cases like depressive or repressive behaviours when one is stressed.

Very often, the changes in spending patterns during these intense periods are driven by personal emotions. For instance, a large portion of spendings before an event (finals per say) is driven by stress and anxiety whereby stress eaters tend to splurge on food while some opt for other forms of entertainment to relieve stress. After an event, however, the spending patterns may vary for they are now influenced by emotions such as anger, guilt or remorse and hence, most will be aggressively spending in places such as the karaoke, gaming centre, or even capcom station to vent out these negative emotions. Conversely, those who experienced positive emotions after an event would probably be able return to their normal spending pattern rapidly.

Spending During Emotional Periods

When you feel stressed, you tend to overspend because it may help you, although just temporarily. During this emotional period, there is unlikely a specific target on which most people will spend money. However, there are a few targets which are very common.

Firstly, food and beverages. Some people spend more on eating and drinking, especially snacks, when they feel stressed as compared to their usual days. Emotional eating is recognised as one of the ways to soothe negative emotions. As it distracts one from negativities, it often leads to mindless overeating. What’s worse is that when we are emotionally hungry, we often crave for comfort food like sweets, chocolate, chips and other high caloric foods. This is obviously different from physical hunger which can normally be satisfied with a wide range of foods. One who is actually hungry is likely to stop eating once they feel full. While physical hunger comes on gradually, emotional hunger hits in an instant. It is possible that we feel hungry (emotionally) for 45 minutes to one hour after taking meal. Even though such hunger does not make sense, we tend to fix our cravings and feel good after that.

Secondly, shopping. Some people feel that they deserve whatever they buy even though they cannot justify the shopping. They will keep convincing themselves that shopping will make them feel better and more motivated to face the reality. They feel satisfied through shopping without realising that this is a trap for them to purchase more and more mostly unnecessary products. This concern has only worsened in today’s world where online shopping has become a global trend across the globe. Due to its convenience, many has the habit of one-click buying. Consequently, when shopping becomes easier, feeling happy becomes easier. This then becomes a dangerous cycle where people would feel stressed ‘more easily’ and always use pressure as a justification for overspending

The greatest danger of overspending during emotional periods is that there is no bottom line. It then becomes an occasional habit to destress which at the end of the day, might result in financial ruin if not properly controlled.

How Does Budgeting Take Place?

Eating three packets of Maggi goreng Tomyam while studying at 3am will not make your smarter and might even cause your stomach to cry for help, which is counter-productive if your exams are on the next day. It goes without saying that budgeting is important for one to manage their personal cash flows smartly and prevent any health issues that may arise from stress eating.

Therefore, the first step is to control your emotions before purchasing or even before the budgeting process takes place. A study by UCL (2006) has confirmed the hypothesis that irrational decisions is caused by our emotions, while the degree of irrational decisions made varies among different individuals. A person with an independent and sound mind is more likely to make better decisions, but many individuals still choose to ignore the advice and decide based on their “mood”. Therefore, before any decisions or budgets are made, calm yourself down and evaluate the possible benefits and drawbacks of making the spending decision.

Secondly, of course, is to identify the amount of resources (or money) available for yourself. From this pool of funds, you can flex your budget according to your liking and possibly acquire better quality products. For example, instead of crunching peanuts when you burn the midnight oil, you can purchase the healthier sunflower seeds to act as a substitute. However, quoting an old Chinese proverb “there is no free lunch in this world”. Money does not just fall out of the sky, but rather acquired through proper means and hard work beforehand.

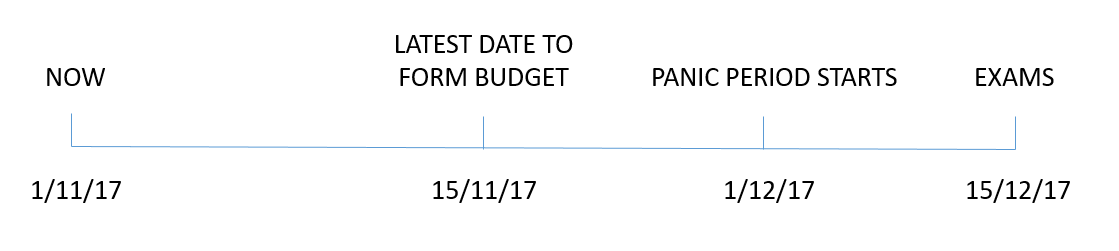

The third step is to plan your budget earlier. If you have concerns of overspending prior to exams, it is best to have a plan to counter it as early as possible. Consider planning a month prior to the examinations and follow it strictly to prevent any misfortunes to your finances. The timeline below illustrates a simple example of good time management and budgeting for the future:

Learn to Know Your “Wants” and “Needs”

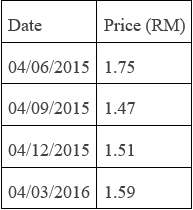

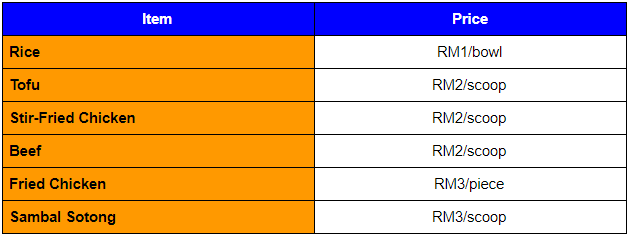

One more important tip in budgeting is being aware whether you’re spending is a “want” or a “need”. In the context of budgeting, “wants” are items that you desire to have and will do just fine without, whereas “needs” are items that you definitely need in any and all situations. Some individuals’ budget may consist of more “wants” than “needs”, thus wasting precious resource allocation. Successfully identifying and separating “wants” from “needs” will save you a lot of money, which may turn to more money for post-exam celebrations instead of blowing up everything before the exams. Consider the illustration below on economy rice:

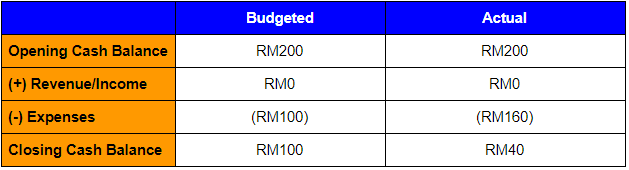

Michael has a budget of RM5 for his ordinary economy rice meal, consisting of rice, tofu, and a choice of either stir-fried chicken or beef. However, due to pre-exam stress, he has decided to take a piece of additional fried chicken or a scoop of sambal sotong for all his economy rice meals in order to “reduce stress”. This happens in all 10 days before the exam date (2 meals of economy rice per day). Simple maths will tell you that he is over his budget by RM60 in the span of 10 days!

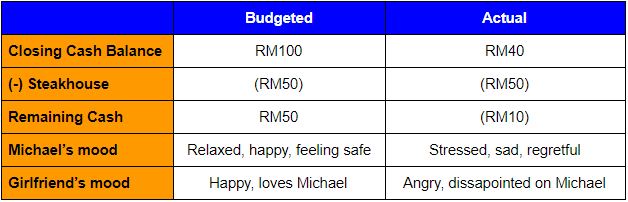

On the 11th day, final exams have finally ended. Michael’s girlfriend wants him to bring her to a steakhouse for post-exams celebration, costing RM50 for 2 people. However, due to the constant overspending of Michael in the past 10 days, he does not have the cash to bring his girlfriend to the steakhouse.

Due to this, Michael was reprimanded by his girlfriend and now his finances are being fully controlled by his girlfriend as she does not trust Michael with his finances.

Note that the above illustration is purely fictional and does not resemble any real-life scenarios, but it does convey two messages. One, discipline is virtue to maintaining a good financial position for an individual; two, budget and expenses should be spent on necessary items, and unnecessary items should be kept till your finances allow it to be purchased. Imagine if Michael had not been rampantly spending on his economy rice meals, he will have cash to treat his girlfriend to the steakhouse and still have an extra RM50 in his pocket to spend on his girlfriend, preserving the image of a good boyfriend and avoiding any potential conflicts.

Pros and Cons For This Form of Budgeting

While budgeting may sound dull and troublesome to most people, there are many direct and indirect ways it can benefit us. The most straightforward ones would be to enable one to plan and minimise unnecessary spending. As simple as it sounds, this will have a large impact on your spendings and savings. Imagine shopping for a list of goods in a supermarket with and without a budget. If you have a budget in hand, you would have to prioritise those items on the the list that is most needed in your cart, enabling you to adjust yours spendings on less important items. In this case, budgeting helps you reassess what is truly important for you at the moment in time, and thus, enhancing your overall quality of life (Quicken, 2017) . On the other hand, one without such a tool would stand a high chance on spending more in total to obtain the same list of items as one will resort to impulsive buying and thus have more freedom in getting items that are not listed. Also, it is clear that budgeting would aid in reducing financial difficulties in daily lives. When faced with stress from examinations, you would obviously want to avoid additional stress from not having enough money to spend before your next allowance. The most simple form of budgeting such as dividing monthly allowances into weekly or monthly budgets would be good enough for a well-controlled personal finance.

As good as budgeting may sound, there are also some drawbacks of budgeting. Especially when you are prone to make irrational choices during these periods influenced by extreme emotions, the budget formed may not be one of the best solutions to solve your underlying problems or to even achieve the goal of your budgeting (to relieve stress in a cost-efficient manner). To make things worse, one may resort to cheat by discontinuing budget planning during these periods to omit their current limits on spendings. While this is not a serious offence in any sense, this action will bridge the initial intention of budgeting, particularly during times when it is most needed to ensure control and balance in one’s personal finance.

Overcoming Problems / Alternatives to Reduce This Form of Spending?

It takes time and effort to overcome emotional spending. As discussed, such a habit is normally a result of feeling stressed. Hence, it is of utmost importance for us to first deal with the triggers that cause us to stress out. There can be a wide range of factors including poor sleeping quality, heavy workload, relationship issues etc. All these may result in us feeling tensed. We have to first recognise the factor, then only can we move on to the next step to cure the underlying problem. For example, if we feel stressed due to heavy workload, it is best and helpful to plan a timetable and adhere to it. In fact, all that needs to be considered when planning a timetable is important but not equally urgent matters. Important tasks contribute to long-term goals while urgent tasks are to be completed within a relatively shorter period of time. Hence, always bear in mind to prioritise what is urgent over what is important while planning. Also, try to look for alternatives that can help with de-stressing. It is scientifically proven that exercise and meditation are even more helpful when it comes to dealing with stress and coping with problems. However, it is undoubtable that sometimes, spending is simply one of the coping mechanism for some people. If that is the case, then the spending must be monitored.

In such situations, it is best to take a step back before going on for another round of shopping and evaluate the spending pattern. List out what you have purchased in the past especially during emotional periods. Looking at the list, people normally realise that most are unnecessary and can be avoided. It is also important to note that the mindset “I deserve this” is no excuse. Neither is “it is just an insignificant amount”, as rewards should not come too often and small amounts add up at the end of the day.

This step of evaluating one’s spending cycle must be done simultaneously with the previous steps. Such compare and contrast approach will then show that the former is better in dealing with tension; lower cost – less spending, better outcome – refreshing mind and work of better quality. Overspending is rarely the way out as the underlying problems would remain unresolved after all.

One point to be noted, this journey is not an all dead fight. After some time, when daily spending is reduced from a maximum of RM 50 to only RM 30, the money saved is the motivation to avoid emotional spending which is most of the time unnecessary. In other words, the accomplishment of saving is satisfying. However, once a blue moon, say, when RM 200 is saved, take a rest and treat yourself. Then, go on and save more for the next!

Conclusion

Spending on emotions is a typical scenario regardless of gender and this is especially true during intense periods such as examinations. Therefore, budgeting plays a key role in managing one’s life. While it is common that most of us live with a fixed amount of allowance from our parents every month, budgeting becomes an essential lesson to us in hope that our pressure during these periods would be lessened or at least excludes financial pressure. As most things come in good and bad, so does budgeting. Hence, the extent to which budgeting can benefit one really depends on how wise and rational a person is in planning and the commitment and determination in continuing the cycle.

[tw-toggle title=”References:”]

Quicken (2017), ‘How Can Budgeting Affect One’s Personal Life?’ [online] Available at: https://www.quicken.com/how-can-budgeting-affect-ones-personal-life Accessed 30 October 2017

UCL (2006), ‘Irrational decisions driven by emotions’ [online] Available at: https://www.ucl.ac.uk/media/library/decisionbrain Accessed 27 October 2017

[/tw-toggle]

Download article here : [download id=”2630″]

Contributors:

Researchers – Lee Hou Yin, Wong Vyleen, Max Kong Chee Yoong

Editor – Lim Shu Ni